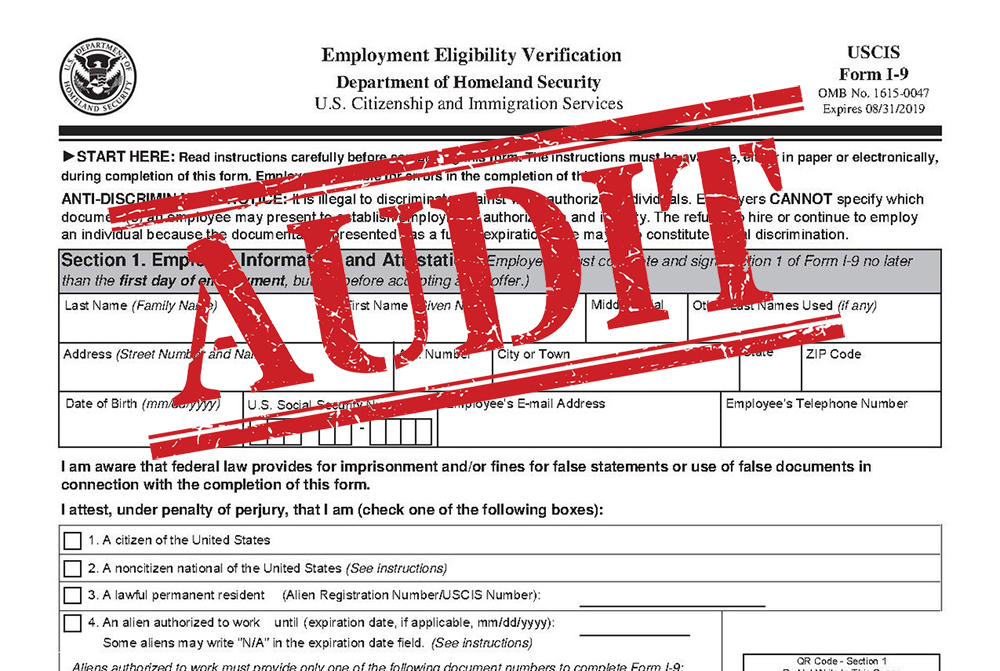

Immigration and Customs Enforcement (ICE) agents descended on chicken plants and other businesses in Mississippi after an investigation into alleged illegal practices by employers and employees. Part of the raid included the companies Form I-9’s being taken and reviewed by ICE agents to ensure their accuracy and compliance with federal law. Agents from ICE take custody of the employer’s documents by auditing them and assessing criminal charges or monetary fines based on inaccuracies. Employers across the Nation should be familiar with the Form I-9 to protect themselves and their businesses from a potential ICE audit. In 2018, ICE served more than 5,200 I-9 audit notices on businesses in the United States. This was one prong of a nationwide operation that looks to ramp up immigration enforcement in the United States.

The I-9 Form is how businesses ensure the identity and employment authorization for the people they hire. These forms are required to be used for citizens and non-citizens in the United States. Every business in the United States is required to complete and maintain Form I-9’s for their employees. The form itself includes a portion for the employee to enter information and a separate piece in which the employer adds information. Individuals can be prosecuted for knowingly and willfully entering false information on these forms and employers are responsible for retaining completed forms.

Employers must be careful not to discriminate against work-authorized individuals in hiring, firing, recruitment, or employment eligibility verification of the Form I-9 based on a person’s citizenship status, immigration status or national origin. Employers who discriminate against individuals on these protected grounds expose themselves to liability. Due to the liability that can arise from discriminatory business practices and from faulty Form I-9 completion and retention practices, businesses should exercise caution when addressing these issues. If your business has received an ICE audit notification letter or you want to protect yourself from liability based on your Form I-9 completion and retention practices, contact Chhabra & Gibbs, P.A., Immigration Team. Our lawyers are well-versed in performing internal audits or counseling businesses on best practices for handling an ICE audit and preventing potential liability. Contact our office at 601-948-8005 or 601-927-8430 or by using our live chat, so we can discuss how to protect your business.

No comment yet, add your voice below!